- All

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Tools

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Best Crypto Portfolio Trackers and Management Apps 2025 Reviewed

A diversified crypto portfolio is one of the pillars for traders and investors alike, but even active traders with advanced crypto backgrounds are keen to forget about the basics. This review sheds some light on popular portfolio management and full portfolio management tracking tools, so you can streamline your trading activity.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

A diversified crypto portfolio is one of the pillars for traders and investors alike, but even active traders with advanced crypto backgrounds are keen to forget about the basics. This review sheds some light on popular portfolio management and full portfolio management tracking tools, so you can streamline your trading activity.

3Commas

Trading platform

3Commas

Binance

A diversified crypto portfolio is one of the pillars for traders and investors alike, but even active traders with advanced crypto backgrounds are keen to forget about the basics. This review sheds some light on popular portfolio management and full portfolio management tracking tools, so you can streamline your trading activity.

A diversified crypto portfolio is one of the pillars for traders and investors alike, but even active traders with advanced crypto backgrounds are keen to forget about the basics. This review sheds some light on popular portfolio management and full portfolio management tracking tools, so you can streamline your trading activity.

HaasBot Review: Pros | HaasBot Review: Cons |

|---|---|

Various technical indicators | Some functionality is hard to set up |

High number of available bots | Support could be more responsive |

HaasBot Review: Pros | HaasBot Review: Cons |

|---|---|

|

|

HaasBot Review: Pros | HaasBot Review: Cons |

|---|---|

|

|

HaasBot Review: An Instant Look

Founded by the current CEO Stephan de Haas back in 2014, HaasBot is a cryptocurrency trading robot hosted by the HaasOnline Trade Server [HTS]. The bot incorporates technical indicators, crypto scripting language HaasScript, backtesting using historical trades, and more.

3Commas

Various technical indicators

Functionality for developers and advanced traders

1

HaasBot Review: An Instant Look

Free access for 3 days

Full-access to our PRO plan

A diversified crypto portfolio is one of the pillars for traders and investors alike, but even active traders with advanced crypto backgrounds are keen to forget about the basics. This review sheds some light on popular portfolio management and full portfolio management tracking tools, so you can streamline your trading activity.

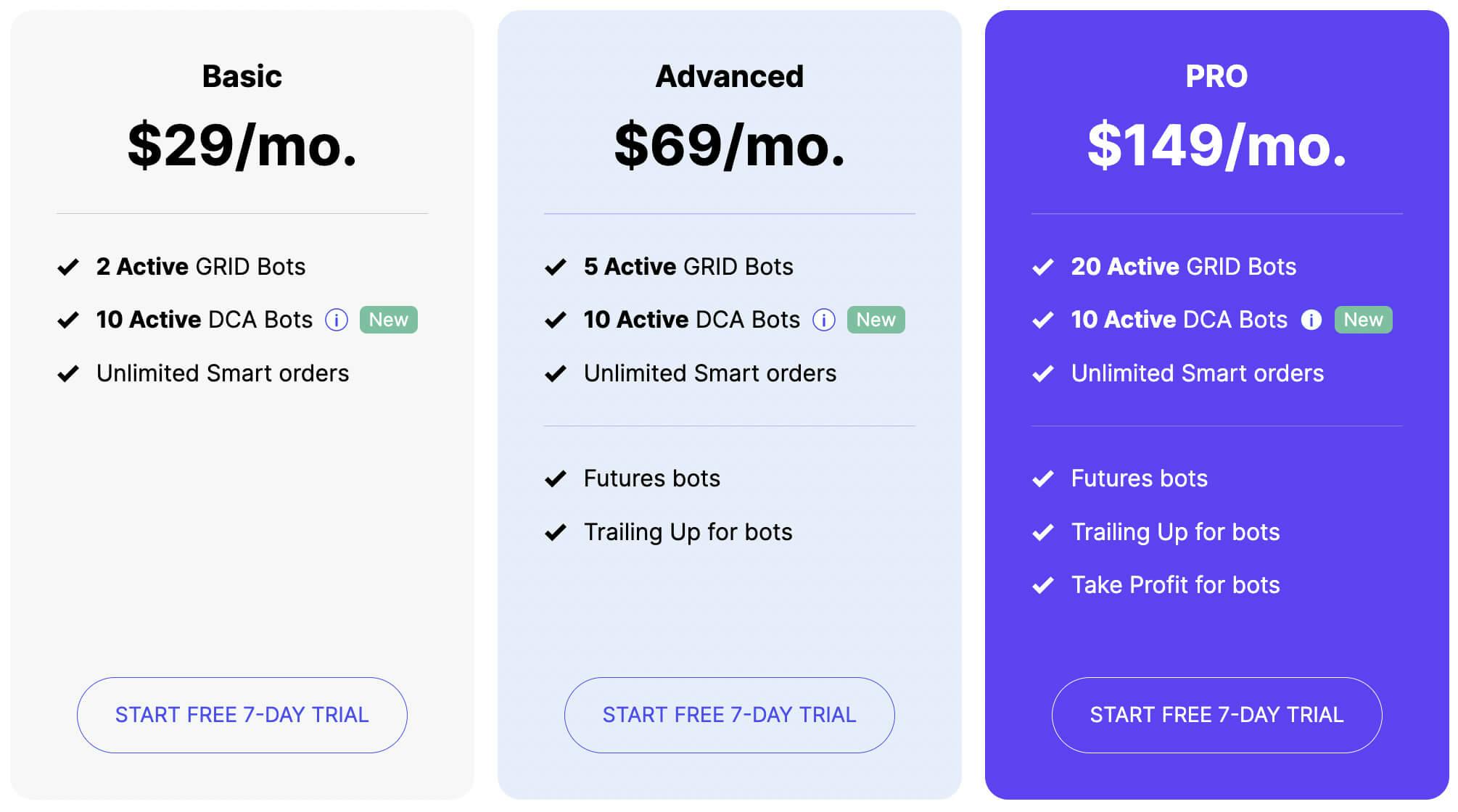

Bitsgap Pricing

2025's Best Crypto Portfolio Management Tools

Blockpit

Blockpit offers comprehensive tracking solutions for a wide range of digital assets including DeFi investments and NFTs. Its tax compliance features as well as regulatory focus makes portfolio management accurate and efficient which makes it a preferred choice for professionals. Blockpit's reporting integrations simplify performance tracking across automated accounts for traders using cryptocurrency auto trading bots.

Kubera

Kubera's asset tracking feature allows for all assets to be arranged in a financial hierarchy system and provides a holistic view by integrating traditional assets with cryptocurrencies. Its read-only approach to data ensures data privacy and security enhancing overall trust for users. Because of its compatibility with crypto trading bots and crypto trading software, Kubera becomes a good choice for those running systematic or algorithmic trading strategies.

CoinStats

CoinStats differentiates itself with its intuitive interface and compatibility with more than 300 wallets and exchanges. For traders using grid bots, signal trading bots, or DCA bots, the coin performance tracking acceleration tool and tax alert features simplify monitoring, which ensures efficient tax reporting.

Delta

Delta supports a wide range of assets including cryptocurrency, stocks, and NFTs, providing comprehensive asset evaluation as well as real-time tracking. Alongside crypto trading bot applications, Delta provides flexible dashboards and synced alerts which are tailor-made for multi-directional trading, aiding asset managers who control diversified portfolios.

Key Features to Consider

Complete Integration: Check if the tool provides comprehensive coverage of exchanges, wallets, and trading bot platforms to allow for effortless data aggregation.

Legal Compliance: Prefer those who provide detailed tax computation reporting, verifiable compliant data, and international standards for crypto tax reporting, especially for owners of crypto trading robots or those employing bots or algorithmic strategies via bot exchange.

Live Performance Measurement: For users operating portfolios managed with cryptocurrency trading bots executing trades based on predetermined signals, immediate access to performance metrics is essential.

Tools providing strong protective measures, security keys, and API access on read-only mode alongside end-to-end encryption should be prioritized when interfacing with any online cryptocurrency trading bot or cryptocurrency bot services.

In 2025, investment management professionals and traders will focus on portfolio trackers that deliver accuracy, sync with automated crypto trading platforms, and facilitate centralized control. The ideal tool transcends basic price monitoring and functions as the central backbone of trading automation where risk assessment, bot supervision, and real-time adjustment strategy execution can all be conducted seamlessly.

FAQ

Crypto traders, investors, and advanced users store funds across multiple blockchains and use different wallets for different purposes. It may cause complicated tracking, which is why most crypto enthusiasts automate the process via crypto portfolio trackers like 3Commas. More of a visual learner? Watch this video about tracking profits & losses.

- point 1

- point 1

- point 1

- point 2

You can rely on crypto portfolio trackers entirely, as they aggregate data from multiple independent sources, ensuring you have up-to-date information. Established and time-tested trackers do not access your funds directly, so you never risk breach or theft.