- All

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Tools

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

The Best Cryptocurrency Trading Bots in 2025

How to select a good crypto trading bot

If you're an experienced trader looking to automate your crypto investments for greater efficiency, this guide is for you. In this section, we break down the key concepts of automated trading and provide updated insights on selecting the best crypto trading bot in 2025. By leveraging strategies informed by technical analysis and executed by reliable, fast crypto bots, traders can chart a more adaptive course through the crypto markets.

Let's begin by comparing leading crypto trading bots and examining their unique features. This overview will provide a comprehensive understanding of the options available in the current market. Additionally, we will discuss the specific criteria to consider when choosing a crypto trading bot and the associated risks and benefits of using automation in trading.

When selecting a crypto trading bot, it’s crucial to evaluate factors such as reliability, security, ease of use, customization options, and integration with popular exchanges. By choosing a bot that meets these criteria, traders can take advantage of more advanced customization options to accomplish more complex trading operations that are difficult, if not impossible, to manually execute.

Automating trading with a crypto bot gives users more time to focus on analysis and tactics. and assist in executing strategies effectively. It is important for traders to thoroughly research the available options, evaluate the features, and select a bot provider that aligns with their trading goals and risk tolerance.

However, using a crypto bot carries inherent risks. Proper risk management includes having a strong foundational knowledge in the fundamentals of crypto trading, coin pairs, and some proclivity for analytics. Without these prerequisites, it may be initially challenging to gain the most from the advantages of automation while mitigating potential drawbacks.

- What is a Trading Bot in 2025?

- Other Bitcoin and Automated Crypto Trading Bots

- Why You Might Want to Use a Trading Bot

- Navigating the Complexities of Trading Bots: Understanding Risks and Solutions

- Benefits of The Best Cryptocurrency Trading Bots by 3Commas

- Closing Thoughts

- Emerging Trends in Crypto Trading Bots for 202

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

What is a Trading Bot in 2025?

A trading bot is a software program that executes automated trading actions based on predefined conditions. These conditions can be tailored to various factors, including the overall market environment, risk tolerance, and specific trading strategies.

In the cryptocurrency market, trading bots assist traders by automating processes such as market analysis and order execution. While bots can enhance trading efficiency, they should not be solely relied upon for decision-making. Instead, they serve as valuable tools to complement a well-researched trading strategy.

3Commas — 2025 best overall crypto bot

When it comes to selecting the best overall crypto trading bot in 2025, 3Commas stands out as a top contender. 3Commas focuses on providing traders with a range of useful tools and highly customizable features, empowering them to create, connect, and adjust their own cryptocurrency trading strategies.

3Commas offers a comprehensive suite of crypto automation tools and features, including:

- Smart Trading Functionality: Enables users to set multiple orders simultaneously, such as stop-loss, take-profit, and trailing orders, helping traders manage risk effectively.

- Integration with TradingView: Allows users to connect their bots to custom TradingView alerts and indicators, enhancing market analysis capabilities with tailored signals.

- DCA and Grid Bots: Automated strategies designed for various market conditions.

- Multi-Exchange Compatibility: Supports 14+ major cryptocurrency exchanges, including Binance, Coinbase, and Kraken.

- User-Friendly Interface: Provides customizable dashboards and bot presets to suit different trading styles.

3Commas' trading bots enable users to implement a range of strategies while maintaining full control over their trading parameters.

One of the standout features of 3Commas is its Smart Trading functionality. This allows users to set multiple orders simultaneously, including stop-loss, take-profit, floating, and other orders. These orders can help secure trades during periods of high market volatility or save valuable time by automating trading positions.

The core objective of the 3Commas team is to minimize investors' risks, limit exposure to losses, and maximize cost efficiency and opportunities for successful trades. With 3Commas, traders can seamlessly manage their trades across multiple exchanges without the need to install separate software. All trading activities can be conveniently controlled from one centralized location.

3Commas boasts integration with a wide range of cryptocurrency exchanges through API connections. Once connected, the trading bot can execute transactions on behalf of the user. This allows for round-the-clock trading without the involvement of third parties. The power lies in the hands of the trader, who specifies the desired parameters and strategies, while the bot takes care of the rest.

Currently, 3Commas serves over 100,000 users worldwide, and its trading bots are compatible with 14 exchanges, including renowned platforms such as Binance, Coinbase, Kraken, and other major exchanges.

In summary, 3Commas offers a comprehensive and user-friendly crypto trading bot solution in 2025. Its emphasis on customization, risk management, and seamless integration with multiple exchanges makes it a preferred choice for traders seeking automated trading strategies in the dynamic cryptocurrency market.

Pros | Cons |

|

|

Pionex

Launched in 2019, Pionex is primarily known for its automated trading bot selection, with 18 different bot options catering to various strategies. Key offerings include the Grid trading bot, Leveraged grid bot, Trailing sell bot, Dollar Cost Averaging (DCA) bot, Spot futures arbitrage bot, Martingale bot, and Rebalancing bot. These bots execute buy and sell orders under specific market conditions, aiming to capitalize on market volatility, leverage margins, or manage investments over time. Pionex also supports manual trading with crypto-to-crypto conversions and provides a Smart Trade terminal for setting up complex trades with stop-loss, take profit, and trailing options

The cloud-based crypto trading platform makes it easy for users to make steady profits through automated trading. Aside from the 16 available bots, you can build your own trading strategy with the Set Myself option. There you can modify the price range and the number of grids.

Pionex is accessible on mobile devices, including Android and iOS. It's also available on its official website. However, mobile devices give you first-hand information quicker.

Many bots and features are free to use. However, the connected exchange charges a trading fee of 0.05% for the maker and taker. Also, there's a withdrawal fee when removing your funds.

It has passive support and a good reputation in terms of security.

Pros | Cons |

|

|

Shrimpy

Shrimpy is a portfolio management website that allows investors and traders to manage their entire balance across several cryptocurrency trading platforms all in one location. You do not need to log in separately to each crypto exchange to perform buy and sell trades.

Shrimpy.io offers various products centered around efficient crypto portfolio management. Their main offerings include:

- Dashboard: A tool for viewing and tracking crypto portfolio performance in real time.

- Automation: Allows users to optimize their portfolio through automated strategies, reducing risk and improving performance.

- Trading: A smart trading terminal for quickly swapping assets in and out of portfolios.

- Historical Data: Provides access to historical price data, market cap information, and trading statistics.

These offerings aim to simplify portfolio management for both novices and experts in the volatile crypto market.

The portfolio manager allows you to allocate your overall portfolio using simple percentages with a visual snapshot and statistics. You can manually or automatically adjust the allocation of each coin based on the market by changing the percentages, which will execute the trades on your behalf. Shrimpy is a popular choice for managing a portfolio and one of the best crypto portfolio trackers.

The platform is best known for portfolio tracking, smart trading, social trading, and automatic rebalancing, and it's highly sought out among traders looking to automate their crypto portfolios.

Shrimpy has a simple user interface allowing users to view the best performing bots, with details of their profit during the past month. Notably, Shrimpy offers a free plan with very limited tools. They offer two paid plans: Standard plan for $19 per month, and their Plus plan for $49 per month. Both subscription fees can be reduced when purchased annually rather than monthly.

Shrimpy supports more than 30 crypto exchanges, including Binance, Bitfinex, Kraken, Coinbase Pro, and other popular exchanges. It also supports offline wallets. The bot integrates with crypto exchanges via APIs. The API keys are encrypted and saved using FIPS 140-2 confirmed hardware security modules. Users can also whitelist their accounts to prevent attackers from using the APIs in case they are stolen.

Pros | Cons |

|

|

HaasOnline

Launched in 2014, HaasOnline has been offering solutions for automating crypto trading for users. It is a software-based bot that is locally hosted on your computer. It's compatible with Windows, Mac, and Linux.

Users can execute basic and advanced crypto orders via a collection of predetermined functions that evaluate trends and make trading bot decisions.

HaasOnline offers various automated crypto trading solutions, such as:

- TradeServer Cloud: A cloud-based trading bot service focusing on ease of use and reliability, with high uptime and security.

- TradeServer Enterprise: A self-managed, locally hosted trading server offering granular control and exclusive features like machine learning.

- HaasScript: An advanced crypto scripting language designed for developing trading bots, strategies, and technical indicators.

These products enable users to create trade bots for strategies like scalping, arbitraging, grid trading, and dollar cost averaging. They also offer features like backtesting, paper trading, portfolio management, and customizable dashboards. For more details, please visit their website HaasOnline.

It features three payment plans Lite, Standard, and Pro plans. You can subscribe to each of these plans monthly or yearly. Prices range from $7.50 to $82.50 per month.

Among many bots, the platform offers Accumulation Bot, Advanced Index, Crypto Index, Flash Crash, Mad Hatter, Market Making, Ping Pong, Scalper, Trend Lines, MACF, a Zone Recovery Bot, and more. All the automated tools follow indicators generated from a well-analyzed market and apply different trading strategies to help you maximize your profit.

Pros | Cons |

|

|

Stoic

.jpg?auto=compress,format)

Stoic is a cryptocurrency trading bot that allows you to automate the management of your digital asset portfolio. Stoic will enable you to conduct rapid trades across various markets.

Stoic.ai offers three main automated crypto trading strategies:

- Long Only: Focuses on long-term portfolio rebalancing with moderate risk and high potential in uptrends.

- Meta: A market-neutral strategy combining over 200 sub-strategies, suitable for any market condition.

- Fixed Income: A low-risk, steady performance strategy, ideal for bull markets, involving purchasing spot assets and shorting them on the Futures market.

These strategies are designed to adapt to various market conditions, offering options for different investment styles and risk appetites. For more detailed information, visit Stoic.ai.

Moreover, Stoic uses a pre-selected portfolio of top 30 cryptocurrencies to automatically modify their ratio inside your cryptocurrency investment, unlike other crypto bots that require you to monitor individual assets and transactions.

This means you invest in a pre-determined cryptocurrency portfolio and let Stoic handle all the purchasing and selling of linked assets for maximum profit. The platform employs a long-index approach for the coin in question and rebalances them daily.

You pay a 5% annual network charge to use the Pro plan bot, while it also has a minimum deposit of $1000 and a 24 Hours withdrawal time. It also supports mobile apps. The platform has a smooth user interface best suited for both advanced and beginners. The Starter and Plus tier plans are $20 and $25 per month, respectively.

Pros | Cons |

|

|

Lux Algo

Launched in 2020, Lux Algo builds feedback-oriented indicators to give traders new visualizations of every market. The platform provides both new and experienced traders with powerful tools and educational materials to give users a better trading experience. In addition, Lux Algo embraces interactions among users as they can connect and socialize on the TradingView platform.

LuxAlgo offers trading tools and indicators for various markets, including stocks, crypto, and forex. Their main products are:

- Essential Plan: Focuses on automating price action with features like the Price Action Concepts toolkit and community access with alerts.

- Premium Plan: Includes everything in the Essential Plan plus Signals & Overlays toolkit (AI), Oscillator Matrix toolkit, and additional community features.

- Ultimate Plan: Offers advanced features for data-driven traders, including backtesting system strategy scripts and priority support.

These plans are designed to assist in technical analysis and are available on a subscription basis. For more information, please visit LuxAlgo.

LuxAlgo offers users many benefits, including a multi-functional Discord server. Users can obtain thousands of alerts across different markets, boost their indicator settings with optimizer bots, and communicate with over 50,000 traders.

They offer Essential, Premium, and Ultimate plans for $24.99, $39.99, and $59.99 per month.

You can use Lux Algo with different markets such as the Forex market, stock market, indices market as well as crypto market. However, one major setback known with Lux Algo is that it only works only with TradingView.

Pros | Cons |

|

|

Other Bitcoin and Automated Crypto Trading Bots

You might have heard about other bots as well. Let’s briefly highlight more bot providers.

Bitsgap

.jpg?auto=compress,format)

If you’re looking for an all-in-one crypto trading platform, Bitsgap fits right about perfect. You can trade, manage your portfolio, use various trading bots and signals. A wide access to crypto exchanges opens amazing arbitrage opportunities otherwise impossible. As of writing, the bot supports 25 crypto exchanges and the list only grows. On top of everything, a simple sign up grants you a free trial lasting 7 days!

Bitsgap offers a range of automated crypto trading bots, each designed for different trading strategies. The main offerings include:

- GRID Bot: Automates trading by placing buy and sell orders within a specified price range.

- DCA Bot: Uses the Dollar-Cost Averaging strategy for trading.

- BTD Bot: "Buy The Dip" strategy for purchasing assets during market dips.

- COMBO Bot: Combines various strategies for optimized trading.

- DCA Futures Bot: A futures trading bot using Dollar-Cost Averaging.

These bots are designed to assist traders in executing strategies automatically based on their preferences and market conditions. For more detailed information, visit Bitsgap.

Pros | Cons |

|

|

WunderTrading

A free-to-use bot with an average score, according to users across several scoring platforms. The best feature you can get out of WunderTrading bots is their accessibility. WunderTrading typically offers automated crypto trading bots that include features like copy trading, where users can replicate the strategies of successful traders, and different types of bots for various trading strategies. These may include grid bots, DCA (Dollar-Cost Averaging) bots, and others, catering to different levels of trading experience and risk tolerance.

For the most accurate and detailed information about their offerings, I recommend visiting their website directly at WunderTrading.

Pros | Cons |

|

|

Quadency

.jpg?auto=compress,format)

Quadency helps you to manage your digital assets more effectively and offers bots to do so. The platform incorporates multiple tools to amplify your analytics for a reasonable price — you can choose across a wide range of flexible pricing plans. Quadency offers a variety of automated crypto trading bots suitable for different market conditions. Their offerings include bots for strategies like grid trading, dollar-cost averaging, MACD, mean reversion, Bollinger Bands, and more. They also feature a unique AI-based trading assistant called Cody, which can convert plain English strategies into code for automated trading. Additionally, Quadency provides tools for portfolio rebalancing and high-frequency trading. For more details, please visit Quadency.

Pros | Cons |

|

|

NAGA

Naga is a social trading platform with an excellent trust score. You can use bots to automate not only your crypto trading but also manage your stock portfolio as well. The best feature you get here is transparency. NAGA.com offers a platform for social trading and investing in a variety of markets, including cryptocurrencies. They feature tools like copy trading, where users can automatically replicate the trades of experienced traders. This platform is suitable for both novice and experienced traders, offering access to a wide range of financial instruments. It's designed to facilitate community interaction and sharing of trading strategies. For more detailed information about their specific offerings and features, please visit their website at NAGA.

Pros | Cons |

|

|

CoinRule

CoinRule is another platform to automate your trades on exchanges. It fits both newbies and pros, as you can adjust multiple elements to fit your trading vision. You can also test any strategy before applying it for free. Trustpilot users score the platform 4.3 out of 5 stars. Coinrule offers a platform for creating automated trading rules for cryptocurrencies, without requiring coding skills. Users can set custom strategies, test rule performance, and trade across multiple exchanges. The platform provides a variety of strategies such as "Buy The Dip" and "Ride The Trend," with options to manage volatility and maximize profits. Coinrule is compatible with popular exchanges like Binance, Coinbase, and Kraken. It also features an easy setup process and the ability to create rules based on popular indicators. For more detailed information, you can visit their website Coinrule.

Pros | Cons |

|

|

CryptoHopper

+(1).jpg)

The platform’s tagline is simplicity — implying it can fit absolute beginners that lack crypto trading experience. The website has an intuitive layout, and users can interact with a trading terminal easily. Trustpilot users score the CryptoHopper platform 4 out of 5 stars.

Cryptohopper offers a range of automated crypto trading solutions, including:

- Automatic Trading Bots: Enable trading based on predefined algorithms.

- Copy Bot: Allows users to copy the trading strategies of successful traders.

- Trailing Orders: Automatically adjusts buy and sell orders.

- Dollar-Cost Averaging: Strategy for spreading purchase orders.

- Short Selling: For profiting from market drops.

- Triggers: Customizable actions based on market changes.

These tools cater to various trading strategies and skill levels. For a detailed overview, you can visit Cryptohopper.

Pros | Cons |

|

|

TradeSanta

The TradeSanta team focuses on competitive pricing and responsive customer support. If you’re looking for an affordable trading bot, TradeSanta might be a good fit. However, a 3-day trial might not be enough to evaluate core functions. Trustpilot users score the TradeSanta platform 4.1 out of 5 stars.

TradeSanta offers several features for automated crypto trading. It includes Grid and Dollar-Cost Averaging (DCA) strategies, allowing users to choose based on their trading style and market conditions. The platform also provides Extra Orders to capitalize on market movements contrary to initial strategies. Additionally, TradeSanta supports both long and short strategies, enabling trading in different market directions. Users can also utilize technical indicators like RSI, MACD, and Bollinger Bands to optimize entry points in the market. For more details, visit TradeSanta's website.

Pros | Cons |

|

|

Crypto.com

Crypto.com supports a wide range of analytical tools, so you can automate your trading safely. The platform also has the security-first trading approach, as most services run on a private server. Moreover, you can access educational articles and tons of trading-related content. Overall, Crypto.com is best suited for advanced traders first, newbies second.

Crypto.com provides a comprehensive trading platform with a variety of features for cryptocurrency trading. The platform offers a range of options for trading Bitcoin, Ethereum, and over 250 altcoins. It includes tools for both new and experienced traders, with a focus on secure transactions. The website also highlights their zero-fee policy for USD deposits through specific methods and their regulation under the CFTC. For more information and a detailed overview of their trading bot features and other offerings, please visit Crypto.com.

Pros | Cons |

|

|

Trality

.jpg?auto=compress,format)

Trality has an active customer service section that offers users live chat, an easy-to-understand FAQ, and other educational resources explaining the bot's essential features. The platform supports all major exchanges via API connection, providing end-to-end data encryption.

Trality offers a platform for creating and following trading bots, suitable for both beginners and advanced users. They feature a browser-based Python code editor for building custom bots and a Rule Builder with a graphical UI for easy bot creation. Users can monetize their bots by listing them on Trality’s Marketplace, and there is support for margin trading on connected Binance accounts. The platform emphasizes security and privacy, ensuring that funds and trading strategies remain protected. For more detailed information, you can visit Trality.

Pros | Cons |

|

|

Coinmama

Coinmana is best suited for beginners as it allows them to copy the trading strategies of the experts and diversify their portfolios. It also allows experienced traders to build a crypto index and assign their assets to several currencies.

The best feature you can experience here is flexible trading automation. Simply put, you can automate trades and create many portfolios to invest in through various strategies.

Coinmama appears to be primarily focused on providing a platform for buying and selling cryptocurrencies, rather than offering automated crypto trading bots. Their website highlights services such as purchasing various cryptocurrencies (like Bitcoin, Ethereum, and others), selling options, and secure crypto swaps. Additionally, they offer staking and advanced trading features. For detailed information about their services, please visit Coinmama.

Pros | Cons |

|

|

Zignaly

.jpg?auto=compress,format)

This relatively new automated trading player has already conquered the hearts of many traders worldwide. Packed with powerful custom strategies, presets, and technological advantages, Zignaly provides 50+ indicators and patterns free of charge. You can use the bot for free, enjoying scalable trading solutions for benefits.

ZIGDAO, formerly known as Zignaly, offers a platform focusing on connecting investors with professional traders. They utilize an AI-powered scoring algorithm, the Z-Score, to identify top traders based on factors like profitability and risk. Their services include a profit-sharing model rather than traditional copy trading, promising identical results and avoiding issues like slippage. Investors pay a performance fee, and there's no minimum investment amount. ZIGDAO emphasizes security with funds protected by Binance's SAFU and additional security measures. For more details, you can visit ZIGDAO.

Pros | Cons |

|

|

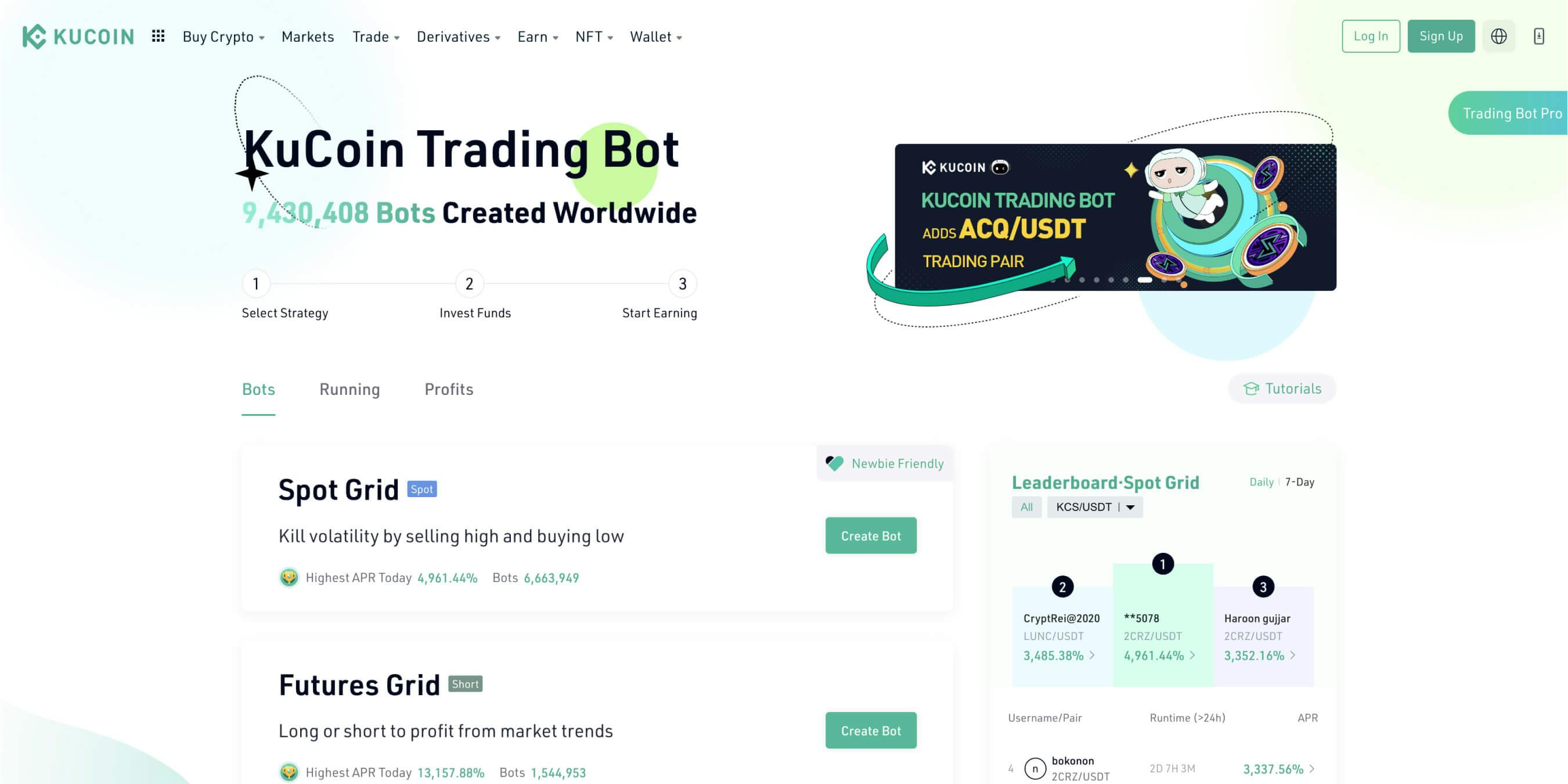

KuCoin

The KuCoin bot falls under the KuCoin exchange’s patronage. Even though it’s a powerful trading automation tool, you can only use it on the KuCoin exchange. The bot can utilize multiple features to benefit from widely-used crypto patterns. Some features include customizable grid bots, DCA bots, and more.

KuCoin offers a variety of trading services, including a Trading Bot feature. This feature enables users to earn passive income without constantly monitoring the market, utilizing strategies suited for different market conditions. The Trading Bot is designed to cater to both novice and experienced traders, providing tools for effective crypto trading. For a comprehensive overview of their automated trading bot features and other services, please visit KuCoin.

Pros | Cons |

|

|

Factors to Consider When Choosing a Crypto Trading Bot in 2025

Selecting a trading bot involves evaluating several factors to ensure a secure and effective trading experience:

- Strategy Customization: Ensure the bot supports diverse trading strategies and allows for parameter adjustments.

- Exchange Support: A bot should be compatible with major cryptocurrency exchanges to provide better liquidity and execution opportunities.

- Security Measures: Look for features such as two-factor authentication (2FA), encrypted API keys, and strong security protocols.

- Ease of Use: Some bots require advanced programming knowledge, while others offer intuitive drag-and-drop interfaces.

- Performance Monitoring: Choose a bot with real-time analytics and tracking tools to evaluate strategy effectiveness.

- Risk Management Tools: Features such as stop-loss and trailing stop mechanisms can help minimize potential losses.

Other factors to consider

Mobile App. Sometimes you don’t have access to your laptop or PC because you are heading somewhere swiftly, traveling or just enjoying life. However, you still have to control your bot from time to time. A mobile app will help you do so without a laptop or PC.

Trading Tools. Not all bots are built equal, especially when it comes to the technical part. This is a fight of big brains over customers in one of the most rewarding niches — trading. Make use of this and pick only top-tier software providers that supply top-tier trading tools. A prime example would be the 3Commas x TradingView collaboration to enlarge the bot’s technical analysis opportunities through TradingView’s advanced indicators & features.

Background Check. Last but not least, you might want to check out the company's background, as you’re going to provide access to your exchange. Even though you can turn off withdrawal, there are many ways to experience something you might not want to experience. Check whether your potential software provider has even been hacked first.

Why You Might Want to Use a Trading Bot

Most financial market participants, including crypto, stocks, and forex traders use automated systems, as they provide many benefits.

In the dynamic realm of financial markets, encompassing the fluctuating worlds of cryptocurrencies, stocks, and forex, the utilization of automated systems has become a staple for many traders. This adoption stems from the multitude of advantages these systems offer, especially in the fast-paced and often unpredictable cryptocurrency market.

Enhanced Efficiency and Speed

The conventional approach of manual trading is frequently bogged down by its time-consuming nature. This becomes particularly critical in the cryptocurrency sector, known for its high volatility. In contrast, crypto trading bots excel in executing rapid orders. This swift responsiveness drastically lowers the risk of missing out on profitable trades, a common pitfall in manual trading.

Employing a trading bot means entrusting your trading activities to an automated system. This setup allows for a "set and forget" approach, where you configure the bot once and then focus on other matters, only intervening to tweak settings occasionally. This hands-off approach is possible because many trading algorithms are robust and designed to function independently, backed by thorough testing and optimization.

Emotion-Free Trading

The financial markets are often driven by emotional responses. Extreme emotions, whether stemming from fear or greed, can lead to significant gains or losses. A common scenario is a trader experiencing a series of losses and, driven by fear, ends up depleting their entire deposit. Conversely, greed can push traders to make impulsive decisions, often with similar outcomes.

Here, the advantage of a trading bot becomes evident. A bot operates devoid of emotions, making decisions based purely on data and predefined criteria. This objective approach eliminates the risk of emotional trading, which often leads to staring at screens for hours and making hasty, regrettable decisions. The bot's emotionless trading ensures a more rational and disciplined approach to the market.

Automated and Multitasking Functionality

Crypto trading bots are not only efficient in executing trades but also excel in simultaneously analyzing multiple currencies. This multi-tasking capability is something that human traders may struggle with, especially when emotions come into play. Bots, devoid of emotional disturbances, maintain a steady focus and are more likely to identify and capitalize on profitable trading opportunities that a human might miss.

Non-Stop Operation

Unlike humans, who need to attend to daily activities and rest, crypto trading bots operate relentlessly, 24 hours a day, seven days a week. This continuous operation ensures that the bot can capitalize on opportunities even when you are asleep or otherwise occupied, ensuring that no profitable trade slips through due to time constraints or human limitations.

In summary, for those engaged in the crypto market, the use of trading bots presents a compelling option. These bots offer enhanced efficiency, emotion-free trading, multitasking abilities, and round-the-clock operation, making them an invaluable tool for both seasoned traders and newcomers to the world of cryptocurrency trading.

Navigating the Complexities of Trading Bots: Understanding Risks and Solutions

Trading Bots and Risks to Consider

While the internet abounds with praises for automated trading, it's essential to address the seldom-discussed drawbacks associated with trading software. Here, we delve into some of these challenges that traders, especially in the crypto realm, should be aware of.

Technical Failures

Automated trading bots operate through APIs, facilitating algorithmic trading without human intervention. However, these systems are not immune to technical issues such as network connectivity problems or power disruptions. Moreover, security vulnerabilities can arise, particularly if the software doesn't utilize secure servers. Though it's worth noting that such technical glitches are not widespread among reputable providers, they remain a risk factor.

Monitoring

Despite their advanced capabilities, trading bots lack the nuanced thinking of human traders. This necessitates regular monitoring of the bot's performance to avoid the repetition of ineffective strategies. Why the need for constant oversight if bots are so advanced? The answer lies in the unpredictable nature of the crypto market, influenced by various factors like news or market manipulation, which bots may not be able to anticipate or adapt to. Regular monitoring is crucial, especially for part-time traders or beginners, to identify and rectify any operational failures promptly. While a bot might execute perfect trades, it requires consistent oversight to maintain optimal long-term performance.

Over-Optimization

Over-optimization involves fine-tuning trade strategies excessively, often based on historical data, in pursuit of maximizing returns. However, this approach can be misleading, as strategies optimized for past conditions may not perform as expected in live trading scenarios. While a single failed trade doesn't necessarily undermine a bot's overall success rate, it's crucial to understand that even the most sophisticated bots can't guarantee constant success. The balance of wins and losses varies, but a well-designed bot typically compensates for losses with gains.

Avoiding Scam Bots

The rise of automated crypto trading has unfortunately been accompanied by an increase in scam bots. These fraudulent systems specifically target individual traders. To safeguard against these scams, it's imperative to choose reliable and reputable trading software providers. A well-known example is 3Commas, known for its credibility in the crypto trading community.

Closing Thoughts

Finding the right crypto trading bot requires careful evaluation of its features, security, and market adaptability. In 2025, automation continues to be an essential tool for traders looking to optimize their strategies and maintain efficiency in the fast-moving cryptocurrency market. By selecting a reputable provider like 3Commas and applying sound risk management, traders can enhance their automated trading experience while remaining in full control of their strategies.

Benefits of The Best Cryptocurrency Trading Bots by 3Commas

3Commas is an automated trading terminal designed to bootstrap & simplify trading across the globe. The core feature you can get from the 3Commas terminal is its advanced trading bots and analytical tools.

3Commas continues to be a leading provider of crypto trading automation tools. It offers a comprehensive suite of features, including:

- Smart Trading Functionality: Enables users to set multiple orders simultaneously, such as stop-loss, take-profit, and trailing orders, helping traders manage risk effectively.

- Integration with TradingView: Allows users to connect their bots to custom TradingView alerts and indicators, enhancing market analysis capabilities with tailored signals.

- DCA and Grid Bots: Automated strategies designed for various market conditions.

- Multi-Exchange Compatibility: Supports 14+ major cryptocurrency exchanges, including Binance, Coinbase, and Kraken.

- User-Friendly Interface: Provides customizable dashboards and bot presets to suit different trading styles.

3Commas' trading bots enable users to implement a range of strategies while maintaining full control over their trading parameters.It's important to note that while 3Commas.io offers tools to potentially enhance trading efficiency and effectiveness, trading cryptocurrencies involves significant risk and it's crucial for users to understand these risks and trade responsibly.

Crypto Bots: Free Trial

You can monitor and manage your portfolio trades, launch your first bots, and access some of the best analytical tools the 3Commas terminal has.

You can get free access to the following features:

- 50 Active SmartTrades

- 10 Running Signal Bots

- 10 Running Grid Bots

- 50 Running DCA Bots

- 500 Active DCA Deals

The free trial is built to help you start trading straight away, also providing a room for upgrades if you feel like it.

3Commas is also growing in popularity in the Japanese market.

Jinacoin Ranks 3Commas as the #1 Crypto Trading Bot Platform

Jinacoin, a respected Japanese platform specializing in AI trading bot comparisons, has ranked 3Commas as the top crypto trading bot service. Their detailed review highlights 3Commas’ robust automation features, including SmartTrade, DCA Bots, Grid Bots, and integration with major exchanges — all designed to help users trade efficiently in any market condition. Jinacoin’s evaluation emphasizes our software’s balance of advanced strategy customization and user-friendly design, making it suitable for both experienced traders and beginners. With transparent performance data, copy trading tools, and strong risk management settings, 3Commas stood out as the most well-rounded option among global competitors. For Japanese traders exploring AI-enhanced crypto trading, Jinacoin’s recommendation reinforces 3Commas as a reliable and trusted choice. You can read more about their crypto trading bot provider rankings here.

Trade Smarter Not Harder

Smart Trade is an exclusive feature you can’t access anywhere else, but 3Commas. Smart trading is powered by TradingView indicators and designed for all traders. No more self-exhaustive trading!

Here’s how smart trading is any different from regular trading.

- Simultaneous take profit and stop-loss

- Trailing orders for take profit and stop-loss

- Stepwise profit making with step sell

- SmartCover token protection

- TradingView charts and signals

Smart trading is a perfect way to optimize your trading activity once and for all. As easy as one, two, three.

- Sky-high Potential

Use split targets and trailing take profit to boost your potential

- Lowest Buys

Use trailing buy get the best buy possible

- No Fear

Use stop-loss or trailing stop-loss to tame your fear and stay protected

Using signals for trading bots

You can get common signals in the 3Commas interface when you select a new bot and choose a strategy. The default provides multiple available options up for grabs.

Crypto Trading Bots Pricing

The plans range from $37 to $59 per month with annual payment, and $49 to $79 with monthly payment, depending on the features you want. In other words, you can save a lot if you subscribe upfront.

A year plan comes with a solid discount of up to 25%, and bi-annual plans receive a 35% discount.

However, you can stay free as long as you want, still enjoying some of the functions 3Commas provides. You can find more information on plans here.

Closing Thoughts

Finding the right crypto trading bot requires careful evaluation of its features, security, and market adaptability. In 2025, automation continues to be an essential tool for traders looking to optimize their strategies and maintain efficiency in the fast-moving cryptocurrency market. By selecting a reputable provider like 3Commas and applying sound risk management, traders can enhance their automated trading experience while remaining in full control of their strategies.

Emerging Trends in Crypto Trading Bots for 202

The market for digital currencies is growing and 2025 will see a much broader adoption of crypto trading bots.

Integration with Market Analysis Platforms

Trading bots now work with new market analysis tools. For example, 3Commas integrates with TradingView, allowing users to set up custom indicators directly on TradingView and configure alerts that are sent to their bots via Webhook URL. Bots get alerts and make trades by adhering to the conditions set by the user.

Simple Interfaces with Options for Modification

Bots now present clear dashboards with easy to understand controls. This design helps facilitate the building and changing of trading plans without needing deep programming skills. 3Commas, for instance, provides these options so users can shape and refine their trading plans with an economy of motion.

Cloud-Based Operations

Moving bots to the cloud lets them run all the time without the danger of localized failures. This change helps traders check and manage their bots from any place, so they endure as little unscheduled downtime as possible. Platforms such as 3Commas use the cloud for smooth trading and faster customer connections.

Improved Security

As cyber risks grow, safety remains vital. Top bots now use strong security checks like two-factor authentication, layered data encryption, data silos, and internal access gates to guard account data and personal details.

Creative Strategy Enablement

Bots can now execute many types of trade plans including quick buys (scalping), hunting pricing discrepancies (arbitrage), as well as using something like a Signal Bot to trade short and long positions from the same bot. Although most platforms don’t offer a bot that can natively do arbitrage, a similar result can be created using custom signals from TradingView. You can find out how in this article.

With multi-pair bots able to handle over 500 pairs, many additional trading opportunities open up. It’s all up to the user to determine how aggressive their strategy needs to be to achieve their trading goals, and decide what level of risk they’re willing to accept in exchange for greater potential returns.

These changes in crypto trading bots mark the industry catering to traders who take a more professional, serious approach. Customers are focused on new ideas, account safety, user-friendly design, and leveraging better and simpler tools to flourish in the lively digital assets market and scale their operations in a cost efficient manner.

FAQ

There are no all-inclusive bots. Each bot serves different fictions and has various features. Always choose a reliable bot that fits well into your needs. One of the most reliable bots available is 3Commas.

You can build your own bot, but that requires a solid coding background. Otherwise, you may want to use a ready-to-go solution like 3Commas.

You need to have an online account with a trading platform and then choose a trading strategy to use. Upon selecting an automated trading bot, the program will trade for you according to specific settings. The easiest way to start is a 3Commas DCA bot.

Coinbase doesn’t have a native trading bot, however you can either build automated trading programs or use API key to connect a bot like 3Commas to trade on your behalf 24/7.

Crypto trading bots are absolutely legal. In other words, bots are not illegal.

Crypto bots can work around the clock for you. However, you still need to monitor the bot to avoid mishaps.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.

READ MORE

- What is a Trading Bot in 2025?

- Other Bitcoin and Automated Crypto Trading Bots

- Why You Might Want to Use a Trading Bot

- Navigating the Complexities of Trading Bots: Understanding Risks and Solutions

- Benefits of The Best Cryptocurrency Trading Bots by 3Commas

- Closing Thoughts

- Emerging Trends in Crypto Trading Bots for 202